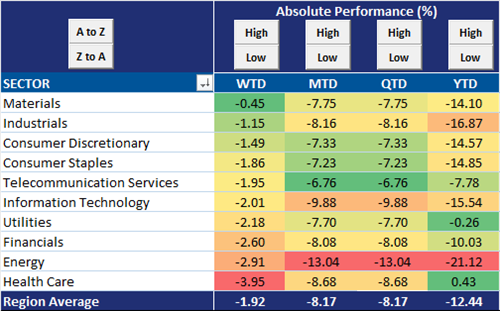

While the DJIA finished slightly lower for the 6th consecutive day, the MSCI North America Index managed to squeak out a 20 bps gain. Late cyclical sectors were by far the strongest of the 10 sectors today.

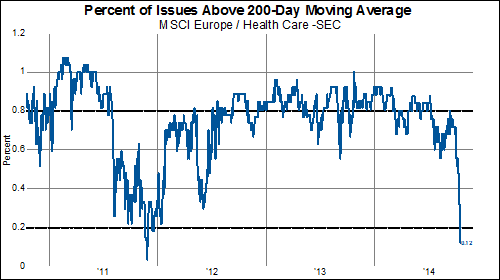

This makes sense to us since these three sectors have exhibited the weakest momentum (i.e. most oversold) recently. For example, before today, only 7% of Energy stocks were trading above its 200-day moving average compared to 68% for the Utilities sector.

From a performance perspective, late cyclicals have also been the weakest sectors as well. Year-to-date, Energy and Industrials have been the worst performing sectors in North America and only another cyclical sector, Consumer Discretionary, has been worse than the materials sector.

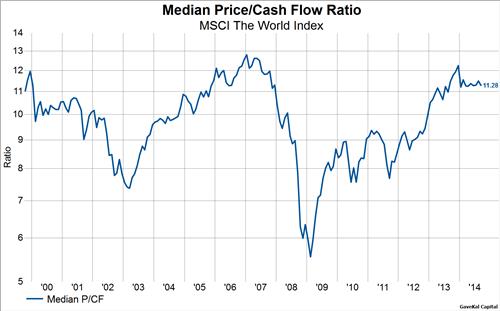

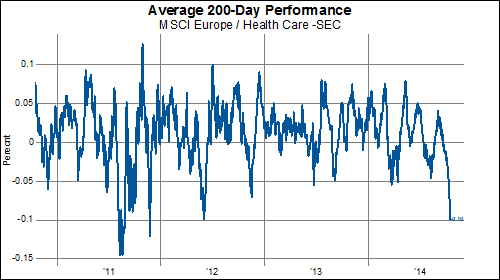

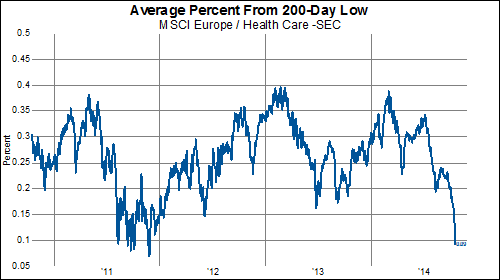

Overall, we would not read anything into today's price action as the trend below seems strongly intact.